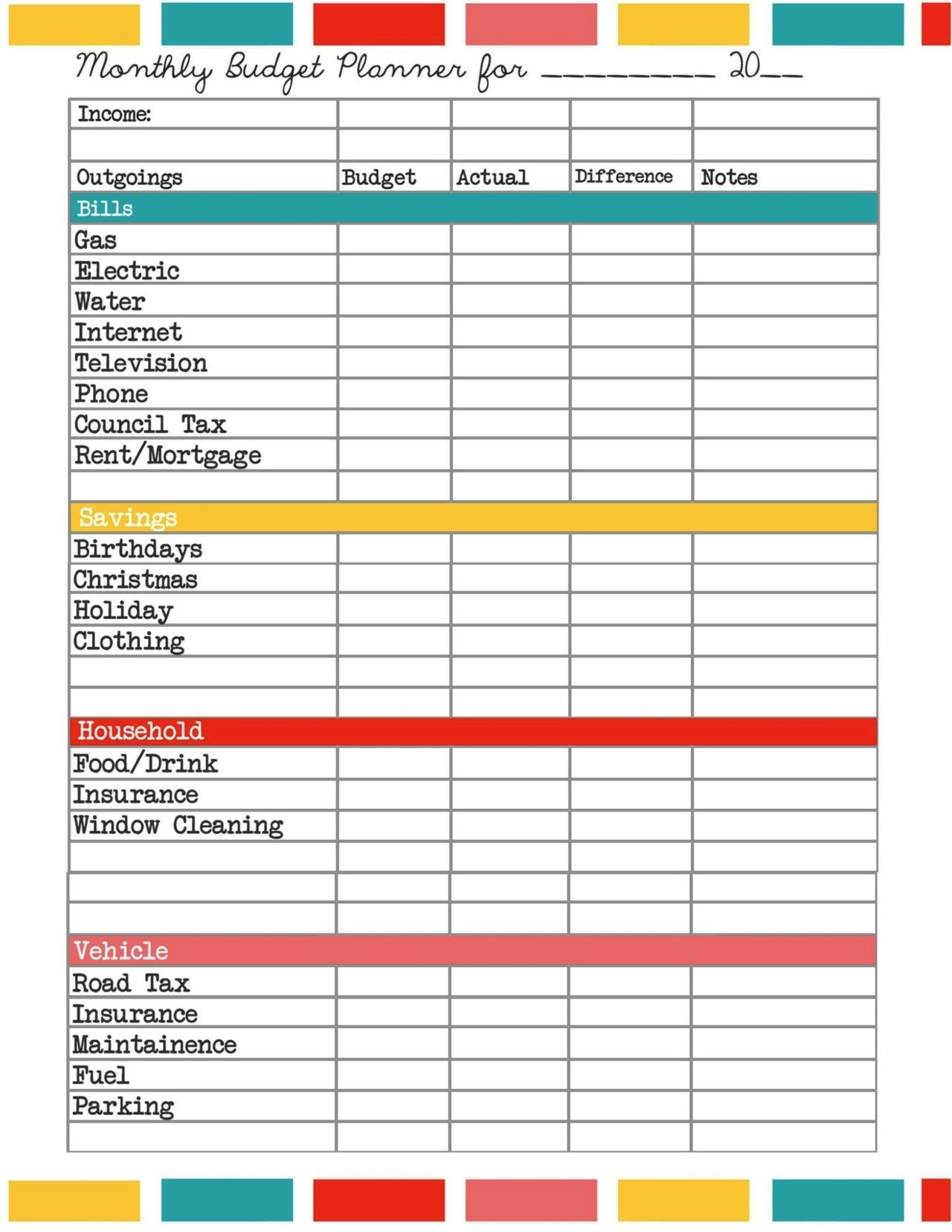

The most important part of a budget planner is that it helps you track every dollar that comes in and every dollar that goes out. It’s used to track your monthly bills, expenses, debt, savings, and more!

Bill budget planner printable free#

It felt like I was counting cards in Vegas! 😁 It totally changed the way I shopped for my staple groceries.Ģ0 Free Budget Printables – I consolidated my favorite free printables into one spot.A budget planner book is a tool that you can use to store all of your financial information in one spot. We all know groceries are cheaper at one store than another, right? When I spent the time to write down my typical grocery list, I found that there were big price differences. Grocery Comparison Sheet – This is so helpful, it should be illegal.

Money Envelope Template – If you haven’t heard of the Cash Envelope System, stick around as it’s a really popular and effective budgeting technique! It helped me when I realized how much money I was spending on things that weren’t that important.

Everyone can find one penny to start this, right?

Penny Challenge – Will saving a single penny help you meet your goals? You betcha! You will be amazed at how fast pennies add up and how it is a fun challenge (especially if you involve kids!) I love to encourage beginners to start here. It is a great daily reminder of your savings goal! Tape this Handy Printable to your Penny Jar or set it on the counter next to it. Monthly Financial Goals (newsletter sign up here).Yearly Financial Goals (newsletter sign up here).In the Mini Budget Binder, you are going to be collecting into one planner: The key to this is to keep working – and keep working – and keep working! Don’t give up until it is all paid off. I had an eye opening experience when I saw how much I spent each month on expensive coffees. The Daily Spending Log will help you see where you are spending money. After a couple of months of tracking, start really analyzing how you are doing.ĭid you take a credit card and continue to charge? Seeing your progress is why this printable is so crucial to your budgeting success!!Īre you seeing the balance go down a little, but not as much as you hoped? Ok, so that is the time to make decisions in your life. The great thing is, the numbers don’t lie. Traditionally, it is best to work off the highest interest rate first but I also like to encourage people to get out of debt in anyway possible. You need to decide which one works best for your personality. This isn’t the smartest financial move, but it does help you feel like this is not an unwinnable task! (I like the feeling of victory when I paid off a balance) That will be a huge victory and you’ll feel like you are stronger to crush the next one even faster. Dave Ramsey suggests you use this Snowball Method once you have $1000 in emergency funds. It doesn’t matter what the interest rate is, but the smaller balance will be paid off more quickly. Option Two: Look at the debt that has the lowest balance.After you paid off the highest rate debt, move on to the next one. The idea here is that you should eliminate the highest interest charges first. This means that you work at paying more than the minimum due each month to knock it out the fastest. Option One: Look for the bill that has the highest interest ( Avalanche Method) and work at paying that one off first.Step Three: There are two different trains of thought here and you should do which one will work best for your personality. Print what you need and just move forward. Now is not the time to overthink how many you SHOULD have. There is room for two Payees for each sheet. Step Two: Fill in each section of the Debt Payoff Printable.

0 kommentar(er)

0 kommentar(er)